South Africa’s Economic Slump Challenges Ramaphosa

Gabriele Steinhauser and Thandi Ntobela, Wall Street Journal, June 4, 2019

{snip}

Africa’s most developed economy fell into its steepest quarterly contraction in a decade, shrinking at an annualized 3.2% in the first quarter, as lengthy power outages hammered key mining and manufacturing sectors.

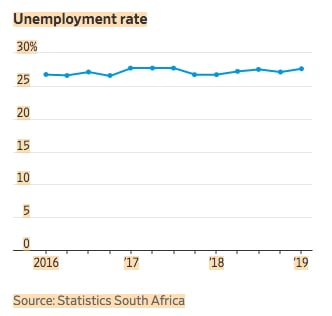

{snip} Since ousting his scandal-battered predecessor Jacob Zuma, Mr. Ramaphosa has failed to boost growth and significantly reduce unemployment, two promises at the center of his campaign for the top job.

Tuesday’s data surprised many South Africans, who are already battling an unemployment rate of more than 27%. Rolling power outages — stemming from a government-owned electricity company that is nearly bankrupt — crippled many businesses.

South Africa’s currency weakened Tuesday, with the U.S. dollar buying 14.691 rand compared with 14.451 the previous day.

{snip} Amid the cuts, South Africa’s mining industry, which was also hit by a five-month strike at a major gold mine, shrank 10.8% on the year, while manufacturing was down 8.8% in the same period.

Agriculture, a smaller contributor to the overall economy, contracted by 13.2%, mostly because of dry weather in central and western South Africa, said Wandile Sihlobo, chief economist at Agbiz.

Overall, it was the economy’s worst quarterly performance since the first three months of 2009, when GDP dropped 6.9% in the wake of the global financial crisis.

Mr. Ramaphosa’s investor-friendly policy proposals, including making it easier to do business in South Africa, are running into opposition within his own party. Just over an hour after the statistics office released the GDP data, the ANC’s secretary-general announced that the party would seek to expand the mandate of the South African Reserve Bank, currently focused on price stability, to also include growth and employment, and said it would explore quantitative-easing policies.

But changing the SARB’s mandate and bringing it into line with the U.S. Federal Reserve and other central banks could disturb investors, as its independence is in enshrined in South Africa’s constitution, and create fears over runaway inflation. The SARB, which is one of the few central banks in the world that still has private shareholders, is still balking at an earlier ANC resolution to nationalize it.

{snip}